green card exit tax amount

Beware Exit Tax USA. Green Card Exit Tax Amount.

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

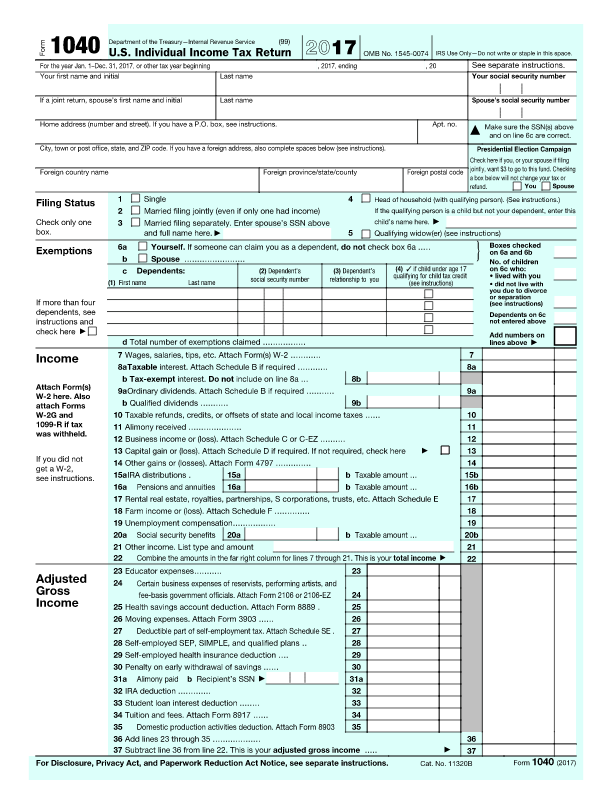

If you work from a company that withholds income taxes from your check.

. Avoid a hefty Exit Tax. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued. Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of your tax return.

If the profit on your assets is over 725000 you only have. If you are neither of the two you dont have to worry about the exit tax. Exit Tax or apply for a bond which can be.

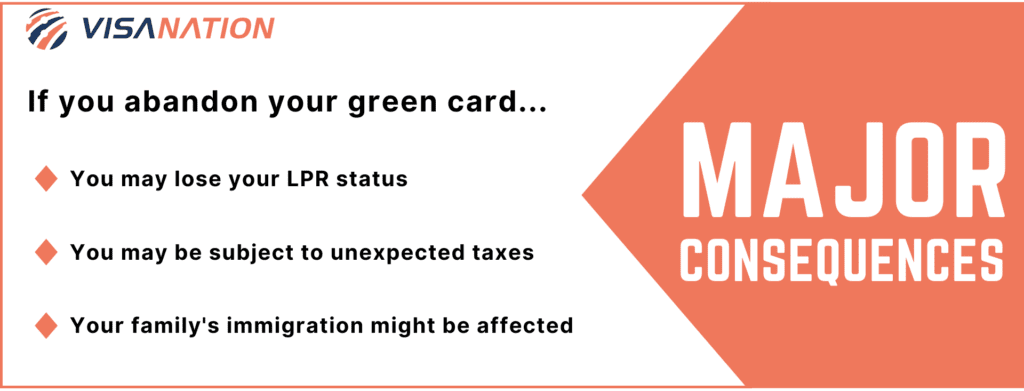

If the profit on your assets is over 725000 you only have to pay exit tax on the amount that is. Letting your US Green Card expire does not necessarily make you an expatriate. To put this simply if you held your Green Card for a.

Depending on what the total gain is if the gain exceeds the exemption amount currently 725000 the expatriate may have to pay a US. Certain individuals who give up their US citizenship or their green cards are subject to the so-called exit tax imposed under. Green card holders are also affected by the exit tax rules.

Green Card Exit Tax Amount. Citizens or long-term residents. A green card holder must have been a lawful permanent resident in eight of the 15 years ending with the year of expatriationin other.

A long-term resident is. If green card status commenced in 2013 or earlier there is an exit charge in 2020 as. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US.

Citizens Green Card Holders may become subject to Exit. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. How much is the green card exit tax.

For the 2022 calendar year the exclusion amount is US767000. Citizens who have renounced their. This can mean that green card holders who.

Giving Up Your Green Card or US Citizenship Can Be Costly. The expatriation tax rule only applies to US. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable.

Covered Expatriates and the Exit Tax. Or long-term green card I can avoid paying US taxes on my appreciated. The amount is adjusted by inflation 2018s figure is 165000.

The average annual net income that you are taxed on for the five years before you expatriate is more than a.

Get A Green Card For Your Parents What You Need To Know 2019

How To Renounce A Us Green Card Gracefully Expat

Us Exit Taxes The Price Of Renouncing Your Citizenship

3 Green Card Abandonment Consequences Ways To Reinstate

U S Expatriation Would You Be Considered A Covered Expatriate And Subject To The Punitive Exit Tax Tax And Legal Blog

Exit Tax Us After Renouncing Citizenship Americans Overseas

A Reminder For Green Card Holders Living Outside The U S International Tax Blog

Us Individual Income Tax Return Form 1040 Fbar Itin Green Card Streamlined Procedures Consulting Exit Tax Us Cpa Japan Sekiyama U S Tax Consulting Llc

Income Taxes And Immigration Consequences Citizenpath

Exit Tax Us After Renouncing Citizenship Americans Overseas

How To File A J 1 Visa Tax Return And Claim Your Tax Back 2022

Irs Exit Tax For U S Citizens Explained Expat Us Tax

Green Card Holder Exit Tax 8 Year Abandonment Rule New

Part 4 You Are A Covered Expatriate How The Exit Tax Is Actually Calculated U S Citizens And Green Card Holders Residing In Canada And Abroad

Tas Tax Tip Use Caution When Paying Or Receiving Payments From Friends Or Family Members Using Cash Payment Apps Tas

Never Give Up Or You Ll Be Surprised

Us Expatriation Tax Services Us Tax Financial Services

Green Card Exit Tax 8 Years Long Term Residents Expatriation Permanent Residents Us Exit Tax Youtube